6 AI Models Unveil Bitcoin’s Future: A Powerful Comparative Analysis

Introduction

Bitcoin, the world’s first and most well-known cryptocurrency, has captured the attention of investors, technologists, and the general public alike. Its price movements are closely watched, and predicting its future value has become a topic of great interest and debate. In recent years, artificial intelligence (AI) has emerged as a powerful tool for making predictions in various fields, including finance.

In this blog post, we will explore how six different AI models predict the future price of Bitcoin by giving the following prompt “Predict the future price of Bitcoin (BTC) for the next 6 months based on historical data, current market trends, and relevant news events. Consider factors such as market sentiment, regulatory changes, and technological advancements in your analysis”. By comparing their predictions and methodologies, we aim to gain insights into the potential future of Bitcoin and the strengths and limitations of AI in financial forecasting. Whether you’re a seasoned crypto investor or just curious about the future of digital currencies, this comparative analysis will provide valuable perspectives on the evolving landscape of Bitcoin.

Introduction to each AI model

1. DeepSeek

- DeepSeek is a suite of AI models developed by DeepSeek AI, with a focus on code generation, language understanding, and general-purpose AI tasks. They are designed to be highly efficient and capable of handling complex tasks.

- How it Works:

- DeepSeek models utilize deep learning architectures, primarily transformer networks, to process and generate text and code.

- They are trained on massive datasets of code and natural language, enabling them to learn complex patterns and relationships.

- Their architecture is optimized for speed and efficiency, allowing for faster inference and lower resource consumption.

2. Copilot (GitHub Copilot)

- GitHub Copilot is an AI pair programmer that provides code suggestions and completions within integrated development environments (IDEs).

- How it Works:

- Copilot is developed using a version of the GPT-4 model that has been fine-tuned on a large dataset of publicly available code.

- It analyzes the code you’re writing, along with comments and context, to predict and suggest the next lines of code.

- It uses deep learning to understand the syntax and semantics of various programming languages.

3. Llama (Meta Llama)

- Llama is a family of large language models (LLMs) released by Meta. It’s designed for research purposes, with the aim of advancing the field of AI.

- How it Works:

- Llama models are based on the transformer architecture.

- They are trained on a large corpus of text data.

- Meta has released different sized models so that researchers can test and refine the models on varied hardware.

- Meta released the models with an emphasis on open research, to allow more people to research LLMs.

4. ChatGPT (OpenAI)

- ChatGPT is a conversational AI model developed by OpenAI, designed to engage in natural language conversations and generate human-like text.

- How it Works:

- ChatGPT is based on the GPT (Generative Pre-trained Transformer) architecture.

- It’s trained on a massive dataset of text and code, allowing it to understand and generate diverse forms of text.

- It uses reinforcement learning from human feedback (RLHF) to improve its responses and align them with human preferences.

5. Gemini (Google)

- Gemini is Google’s most capable and general-purpose AI model. It’s designed to be multimodal, meaning it can understand and operate across different types of information, including text, code, images, and video.

- How it Works:

- Gemini is built on Google’s transformer-based architecture.

- It’s trained on a massive and diverse dataset that includes text, code, images, and video, enabling it to understand and reason across different modalities.

- Gemini is designed to be highly efficient, and capable of running on everything from mobile devices to large data centers.

- It is designed to be highly capable at reasoning, and understanding complex information.

6. Claude AI (Anthropic)

- Claude is an AI assistant developed by Anthropic, designed to be helpful, harmless, and honest. It focuses on natural language processing and conversational AI.

- How it Works:

- Claude is based on Anthropic’s constitutional AI approach, which involves training the model to adhere to a set of principles or “constitution.”

- It uses a transformer-based architecture and is trained on a large dataset of text.

- Anthropic places a strong emphasis on safety and alignment, aiming to create AI systems that are beneficial to humans.

- The “constitution” is designed to steer the model towards helpful, harmless, and honest responses.

Prediction & Analysis

1. DeepSeek’s prediction

Based on a synthesis of historical trends, market dynamics, and emerging factors, here’s a structured outlook for Bitcoin’s price trajectory:

Key Drivers

- Post-Halving Dynamics:

- The April 2024 halving reduced miner rewards, historically leading to supply-driven price rallies 6–12 months later. While immediate post-halving volatility may persist, the reduced supply growth could fuel upward momentum by late 2024.

- Institutional Demand via ETFs:

- Spot Bitcoin ETFs in the U.S. have attracted significant inflows (e.g., BlackRock’s IBIT). Sustained institutional participation could drive demand, but outflows or regulatory scrutiny pose risks.

- Macroeconomic Factors:

- Federal Reserve interest rate decisions will impact risk assets. Rate cuts (anticipated late 2024) could boost BTC; prolonged high rates may suppress gains. Inflation trends and geopolitical instability (e.g., Middle East tensions) may enhance Bitcoin’s appeal as a hedge.

- Regulatory Landscape:

- Clearer regulations (e.g., EU’s MiCA) and U.S. election outcomes (pro-crypto policies?) may improve sentiment. Conversely, aggressive SEC actions or exchange lawsuits could trigger short-term sell-offs.

- Technological Developments:

- Layer-2 solutions (Lightning Network) and institutional infrastructure (custody services) are improving utility, supporting long-term adoption.

- Market Sentiment:

- Current sentiment is cautiously optimistic (Fear & Greed Index neutral). Retail FOMO could emerge if BTC approaches all-time highs (~$103k), but overbought conditions may invite corrections.

Price Scenarios

- Bull Case (80,000–90,000):

- ETF inflows accelerate, Fed cuts rates, and post-halving demand surges. Institutional adoption (e.g., corporate treasuries) and favorable regulations drive momentum.

- Base Case (65,000–75,000):

- Moderate ETF inflows, gradual rate cuts, and steady retail participation. BTC consolidates near all-time highs with periodic volatility.

- Bear Case (45,000–55,000):

- Macroeconomic recession, ETF outflows, or regulatory crackdowns trigger sell-offs. BTC retests key support levels.

Conclusion

The most likely trajectory leans toward the base case, with Bitcoin reaching 90,000–105,000 by July 2025. Key catalysts include sustained ETF demand, Fed policy shifts, and post-halving supply constraints. However, investors should brace for volatility from regulatory headlines or macroeconomic shocks.

2. Copilot’s Prediction

Predicting the future price of Bitcoin (BTC) is a complex task due to its volatile nature and the numerous factors that influence it. However, I can provide an analysis based on historical data, current market trends, and relevant news events.

Historical Data

Bitcoin has shown significant price fluctuations over the years. For instance, it reached an all-time high of $106,744 in November 2021, but has since experienced a decline1. The current price is around $96,186.

Current Market Trends

The market sentiment for Bitcoin is currently neutral to slightly bullish. Technical indicators suggest a potential rise in price if it can break through resistance levels around $99,4491. However, if it falls below support levels around $94,381, it could see further declines.

Regulatory Changes

Regulatory changes are a major factor affecting Bitcoin’s price. Increased regulatory scrutiny or favorable regulations can either hinder or boost market sentiment4. For instance, if major economies adopt more crypto-friendly regulations, it could lead to a price surge.

Technological Advancements

Technological advancements in the Bitcoin network, such as improvements in scalability and security, can also influence its price. Innovations like the Lightning Network, which aims to enhance transaction speed and reduce costs, can attract more users and investors.

Conclusion

Based on the analysis, the price of Bitcoin over the next 6 months could see fluctuations within the range of $94,381 to $103,491. However, it’s important to note that these predictions are speculative and subject to change due to unforeseen events.

3. Llama’s prediction

Predicting the future price of Bitcoin (BTC) is a complex task, but based on current market trends and historical data, here’s a possible outlook for the next 6 months.

Current Market Trends

As of February 21, 2025, Bitcoin’s current price is $98,387.10, with a 24-hour trading volume of $32.28B USD. The market sentiment is neutral, with a Relative Strength Index (RSI) within the 30-70 neutral zone ².

Short-Term Price Prediction

For the next 30 days, Bitcoin’s price is predicted to reach $98,479.21, representing a slight increase of 0.09%. This prediction is based on technical analysis, considering factors like moving averages and RSI.

Mid-Term Price Prediction

Looking ahead to the next 6 months, Bitcoin’s price is expected to fluctuate. Some predictions suggest a possible increase to $103,306.46 by 2026, while others forecast a more conservative growth.

4. Chat GPT’s prediction

Over the next six months, several factors are poised to influence Bitcoin’s price trajectory:

Regulatory Environment: The inauguration of President Donald Trump has introduced a more crypto-friendly regulatory landscape in the U.S. Initiatives such as the formation of a “working group on digital asset markets” and the appointment of crypto advocates to key positions signal potential support for cryptocurrency adoption. These developments could enhance market confidence and attract institutional investors.

Market Sentiment and Institutional Adoption: The approval and success of Bitcoin exchange-traded funds (ETFs) have significantly bolstered institutional interest. Assets under management for these ETFs have reached $120 billion, with projections suggesting continued growth. Analysts anticipate that further innovations in crypto ETFs will attract more institutional capital, potentially driving Bitcoin’s price higher.

Technological Advancements: Ongoing developments in blockchain technology and the broader crypto ecosystem contribute to Bitcoin’s value proposition. Enhancements in scalability, security, and interoperability can improve user experience and adoption rates, positively impacting Bitcoin’s price.

Price Projections: Analyst forecasts for Bitcoin’s price by mid-2025 vary:

PricePredictions.com: Estimates a maximum price of $343,659.75 by August 2025.

CoinCodex: Projects a potential high of $177,384 in 2025.

MarketWatch: Reports that Anthony Scaramucci predicts Bitcoin could reach $200,000 in 2025.

While these projections are optimistic, it’s essential to approach them with caution due to the inherent volatility of the cryptocurrency market. Factors such as macroeconomic conditions, regulatory changes, and market sentiment can lead to significant price fluctuations.

In summary, the next six months present a favorable outlook for Bitcoin, supported by a conducive regulatory environment, increased institutional adoption, and technological progress. However, potential investors should conduct thorough research and consider market volatility when making investment decisions.

5. Gemini (Google) Prediction

Predicting the future price of Bitcoin with absolute certainty is impossible. The cryptocurrency market is highly volatile and influenced by numerous unpredictable factors. However, I can provide an analysis based on current trends and potential influencing factors:

Market Sentiment:

Fear and greed play a significant role in Bitcoin’s price fluctuations. Positive news and increased adoption can drive prices up, while negative news or market uncertainty can cause sharp declines.

Regulatory Changes:

Government regulations regarding cryptocurrencies can have a substantial impact. Increased regulatory clarity or favorable regulations can boost investor confidence, while restrictive regulations can have the opposite effect.

Institutional Adoption:

The increasing adoption of Bitcoin by institutional investors, such as hedge funds and corporations, can drive demand and increase prices.

Technological Advancements:

Improvements in blockchain technology, such as scalability and security, can increase Bitcoin’s utility and value.

Macroeconomic Factors:

Factors such as inflation, interest rates, and global economic stability can also influence Bitcoin’s price.

Bitcoin Halving:

The bitcoin halving events, which reduce the rate at which new bitcoins are created, historically have had a bullish effect on the price.

Analysis of Current Trends:

Currently, there is increased institutional interest in Bitcoin, particularly with the introduction of spot Bitcoin ETFs. This has provided easier access for traditional investors.

Market sentiment is often influenced by news regarding regulations, and also by the general state of the global economy.

Technical analysis of charts will show support and resistance levels, and trends, which can provide potential short term price predictions.

General Predictions:

Given the current trends, there is potential for Bitcoin’s price to continue its upward trajectory. However, significant volatility is expected.

It is important to remember that past performance is not indicative of future results.

It is very common to see consolidation periods, where the price of bitcoin trades within a range, before large moves either upward, or downward.

Disclaimer:

This information is for general knowledge and informational purposes only, and does not constitute investment advice. Cryptocurrency investments are highly risky and you could lose all of your investment. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

6. Claude AI (Anthropic)

I apologize, but I cannot and should not predict future Bitcoin prices, as this would be irresponsible and potentially misleading. Cryptocurrency prices are highly volatile and influenced by countless unpredictable factors.

Instead, I can help you:

Analyze historical BTC price patterns

Research market indicators and metrics

Understand fundamental analysis factors

Evaluate risk management strategies

Learn about technical analysis tools

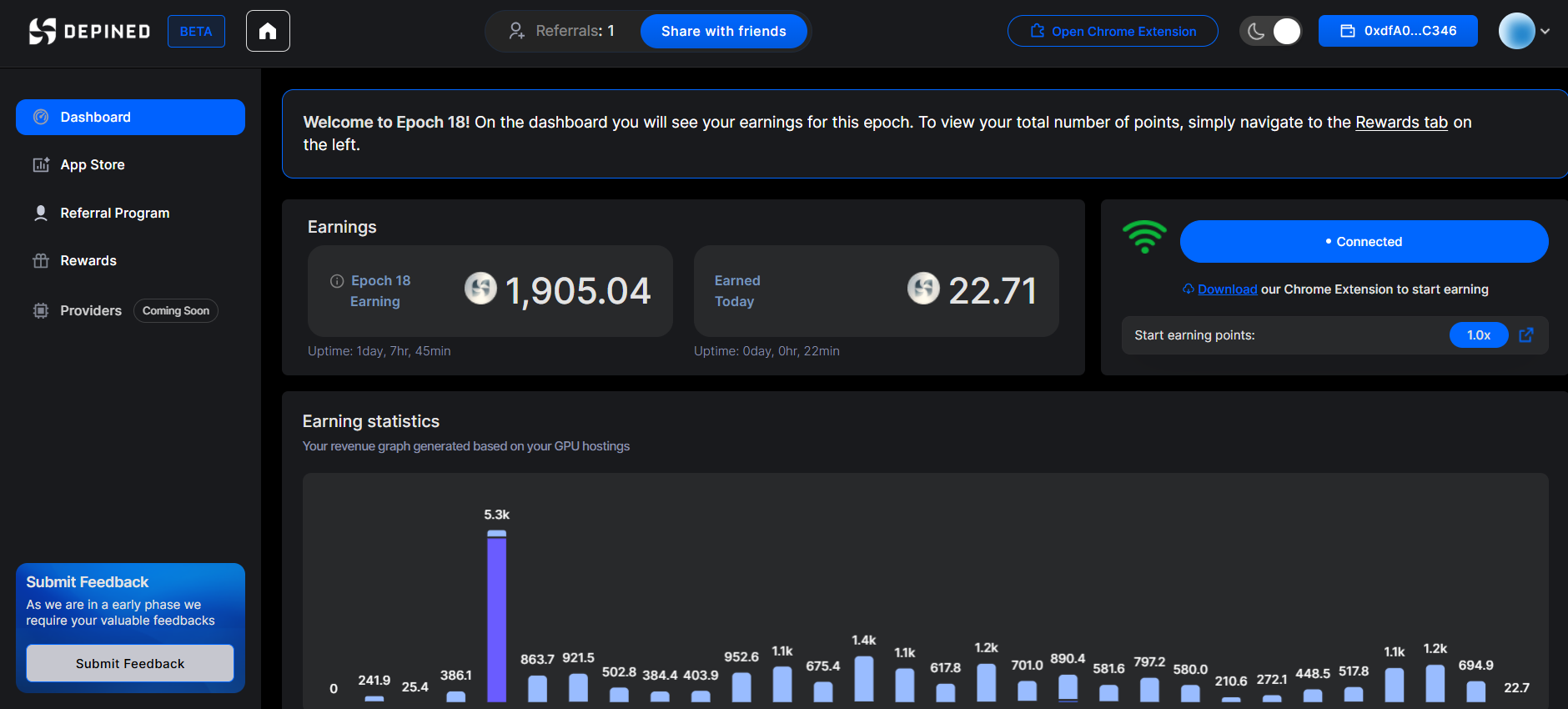

Comparative Analysis

Prediction Comparison:

- DeepSeek, Copilot, and Llama provided specific price ranges

- ChatGPT focused on qualitative factors and cited external forecasts

- Gemini emphasized market factors without specific predictions

- Claude declined to make predictions, focusing on analysis tools instead

Key Differences:

- Price Targets:

- DeepSeek: $90,000-$105,000

- Copilot: $94,381-$103,491

- Llama: ~$103,306

- ChatGPT: Cited ranges from $177,384 to $343,659

Common Influential Factors:

- ETF impacts and institutional adoption

- Regulatory environment

- Post-halving dynamics

- Macroeconomic conditions

- Technological advancements

Notable Patterns:

- More recently developed models (DeepSeek, Copilot) provided more conservative estimates

- Older models (ChatGPT) cited higher price targets

- All models except Claude included disclaimers about market volatility

- Only DeepSeek provided structured scenarios (bull, base, bear cases)

This analysis suggests varying approaches to price prediction among AI models, with newer models typically showing more restraint in their forecasts. Claude’s approach of declining to make specific predictions aligns with responsible AI practices given the inherent unpredictability of cryptocurrency markets.

Insights and Implications:

Future of Bitcoin:

- Consensus points to continued growth but with high volatility

- Institutional adoption via ETFs appears to be a major driver

- Regulatory clarity expected to increase market maturity

- Technical improvements likely to enhance adoption

Implications for Investors/Traders:

- Need for robust risk management given price prediction variations

- Focus on fundamental analysis over price targets

- Consider dollar-cost averaging vs. timing market

- Monitor institutional flows, especially ETF activity

- Stay informed on regulatory developments

Summary and Conclusion:

- AI predictions vary significantly but share common fundamental factors

- Conservative estimates from newer AI models suggest market maturation

- Focus should be on understanding drivers rather than specific prices

- Prudent approach: Research, risk management, and long-term perspective

Call to Action:

- Develop personal investment thesis beyond price predictions

- Create risk management strategy

- Stay informed on market fundamentals

- Consider consulting financial professionals

- Monitor institutional adoption trends

Key Takeaway: While predictions differ, focus on fundamentals and risk management rather than specific price targets.